What threats does generative AI pose to payment services and how can we mitigate them?

Anson: We embrace it because we use AI for “rehearsals” before we engage with regulators. AI can be a friend or a threat, it depends on how you use it.

Do you think that regulators generally take protection of users of crypto less seriously than users of fiat?

Anson: They take it very seriously at the highest levels, and encouraging regulators globally to enact a licensing regime for their respective jurisdictions.

Do you see malware related concerns beyond banking industry and MAS guidelines touching payment and ECommerce apps too?

Anson: Malware inherently is beyond banking by nature. It’s basically an installation of illicit software on your phone through baiting the user on making it happen e.g. Getting a user to download a particular app or clicking a particular link to download the app.

Do legal firms work with law enforcement agencies in money recovery? SPF reported fraud loss of over $660m in last year – how & if can this theft be recovered?

Anson: In reality, you would need a court injunction in order to require the FI to open up the target customer account and retrieve the funds.

Can industry converge and create platform for shared attr of malicious actors like device id, id no, mob no, account no similar to open source governance.

Anson: There’s a lot of privacy issues and possible law suits that may happen as you can never be 100% certain that that particular person or identity, is really a malicious actor.

What are the emerging trends or potential regulatory changes in global payments system that the businesses should be preparing for next 3 to 5 years?

Anson: We see a convergence of crypto, especially stablecoin payments, into the traditional financial ecosystem. This is because there are very real business use cases where commerce can be operated more efficiently with stablecoins. Many jurisdictions are currently ramping up on respective regulatory frameworks to enable the opportunity for crypto and stablecoin payments.

How has the banning of the crypto by the Nigerian regulator led to the impact on the currency value and massive devaluation of the currency against the USD.

Actually the ban was on banks where they were not allowed to onboard crypto service providers. Crypto Service Providers can now apply for licenses in Nigerian and engage banks to get a bank account. Read more.

If transaction is authenticated via biometric is there a possibility of liability coming to FI. Or would device manufacturers also come into fold?

Anson: The FI will also have the liability and this is imposed by MAS. To mitigate and manage the liabliity, all FIs that conduct NF2F KYC will require an annual audit on the process as well as the vendor itself.

—

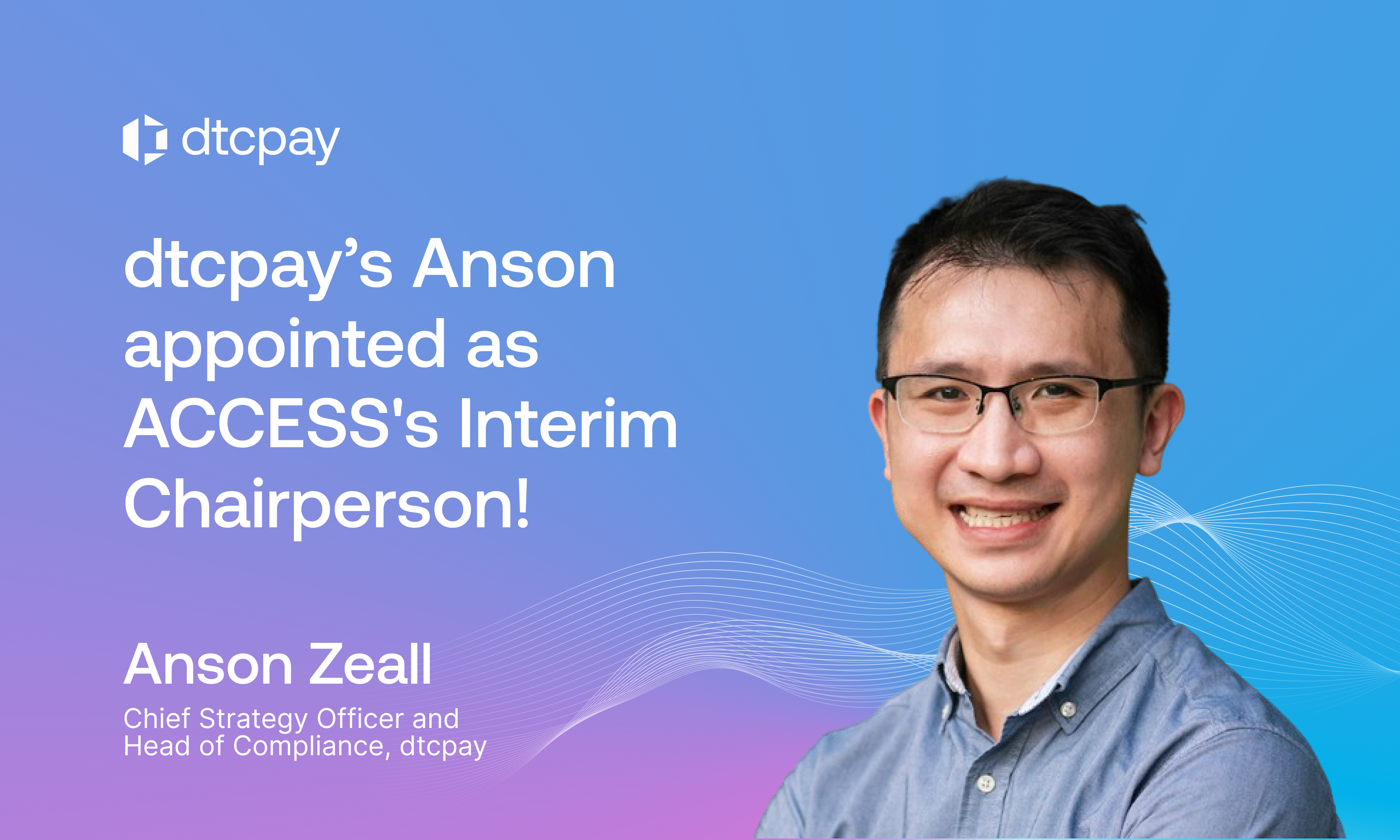

About dtcpay

dtcpay is a regulated payment service provider that offers reliable solutions for merchants to grow their revenues with higher acceptance rates for Fiat and cryptocurrency transactions. Our clients’ customers benefit from frictionless payment experiences whether they are using our award-winning POS+ terminal in-store or using our online checkout.

Founded in 2019 in Singapore, dtcpay is a licensed Major Payment Institution (MPI) under the Monetary Authority of Singapore (MAS) and offers Digital Payment Token (DPT) services.

Get in touch if you’d like to learn how dtcpay can help facilitate swift and secure cross-border payments for your businesses!

LinkedIn | X | Instagram | Facebook | YouTube

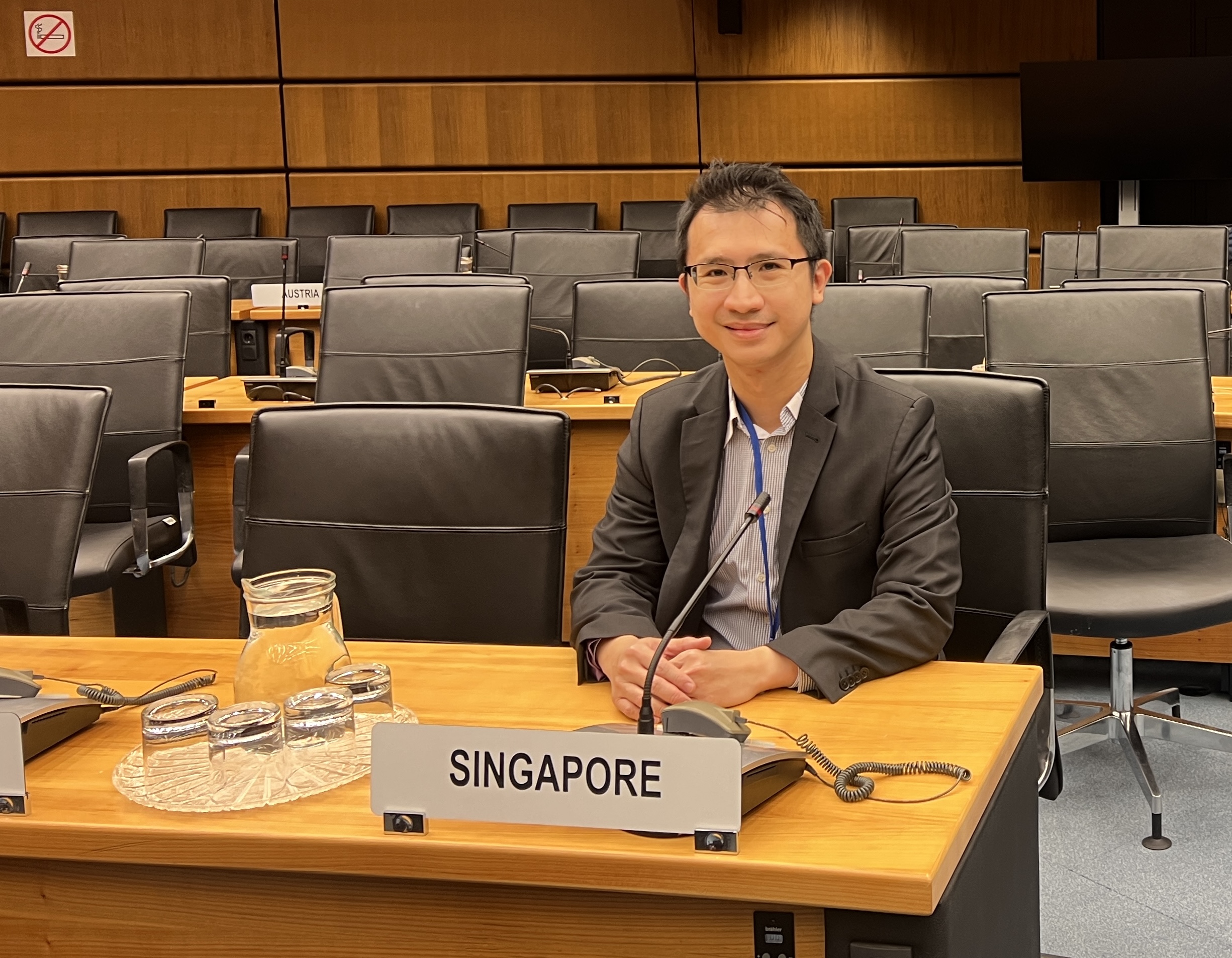

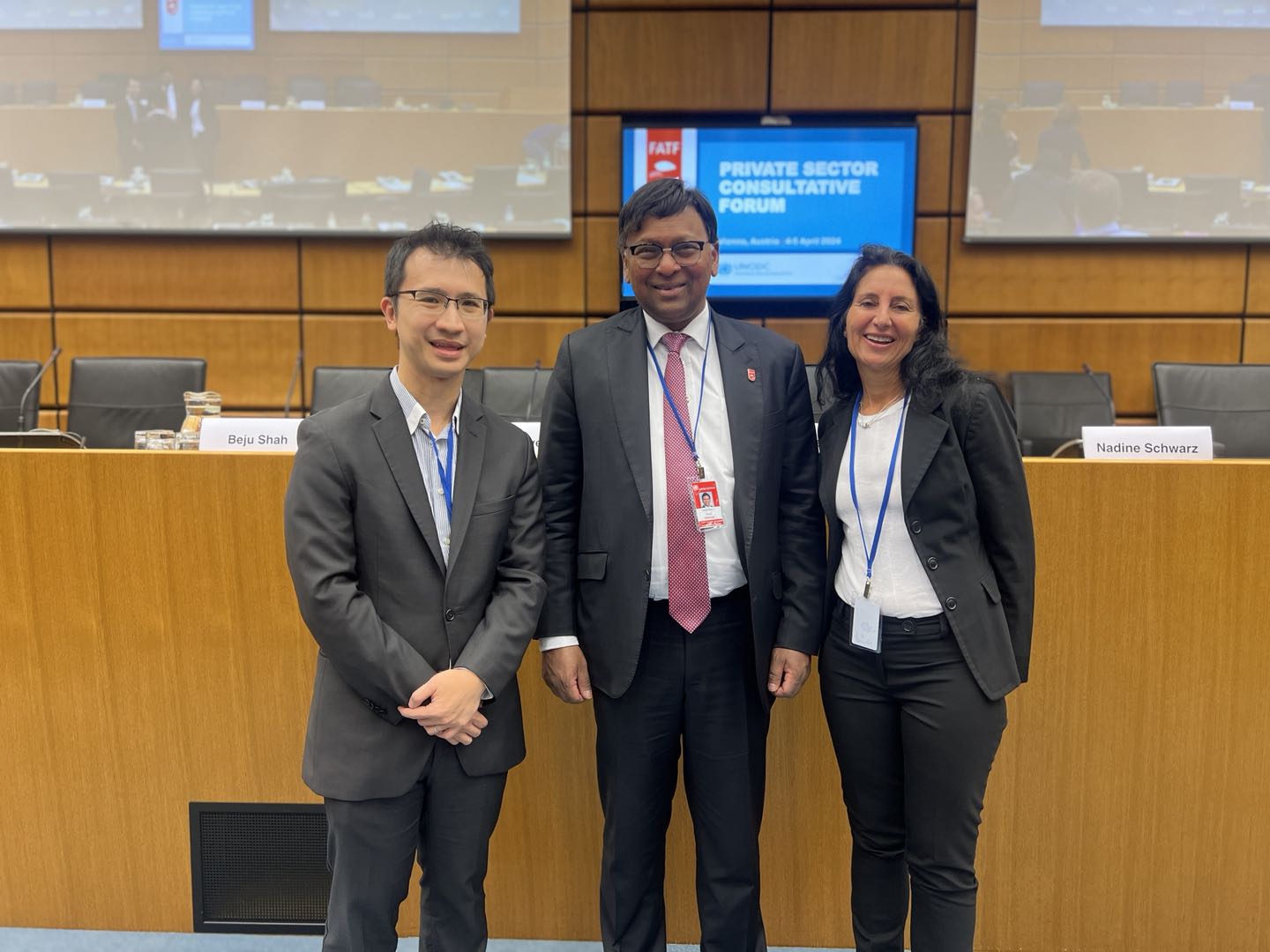

Anson at the inaugural meeting of the CATF with MAS, hosted by ACCESS. A pivotal moment strengthening the collaboration between regulators and licensed DPT players, laying the groundwork for a stronger financial sector.

Anson at the inaugural meeting of the CATF with MAS, hosted by ACCESS. A pivotal moment strengthening the collaboration between regulators and licensed DPT players, laying the groundwork for a stronger financial sector.