Media Feature

Singapore-based dtcpay to Launch Payment System with Fiat and Crypto Assets

As featured on CoinMarketCap, Nov 2023

14 Nov 2023 • 2 mins Read

As featured on CoinMarketCap, Nov 2023

Singapore-based dtcpay to Launch Payment System with Fiat and Crypto Assets

The cryptocurrency sector continues to integrate into our daily lives. In line with this, Singapore-based dtcpay has announced that it will launch a payment system that will use fiat and crypto assets for in-store and online payments. The company mentioned Tether, Ethereum, and Bitcoin in its announcement regarding the payment system.

Noteworthy Details in the Announcement

In the announcement made by the company, it stated that it will establish a partnership with PlatON, an open-source blockchain network for privacy-focused crypto payment system infrastructure, and Allinpay International to create smart terminals and a digital interface. Both PlatON and Allinpay stand out for being China-based. Dtcpay and Allinpay are registered as major payment institutions with the Monetary Authority of Singapore (MAS). A spokesperson for Tonghua International, the parent company of Allinpay, stated the following in the announcement:

“This collaboration will help companies better adapt to the modern payment trend and meet the needs of young consumers.”

Dtcpay will conduct fiat and crypto exchanges in the new service that will be offered and incorporate new cryptocurrencies into the system. It already offers point-of-sale and online payment services. In September, dtcpay signed an agreement with Sumsub, a London-based company, to provide Know Your Customer (KYC) services for dtcpay crypto wallet, and reached an agreement with Jeripay, a Singaporean POS provider, to provide crypto payment services on its network with 8,000 terminals.

Singapore: The Rising Star of Recent Times

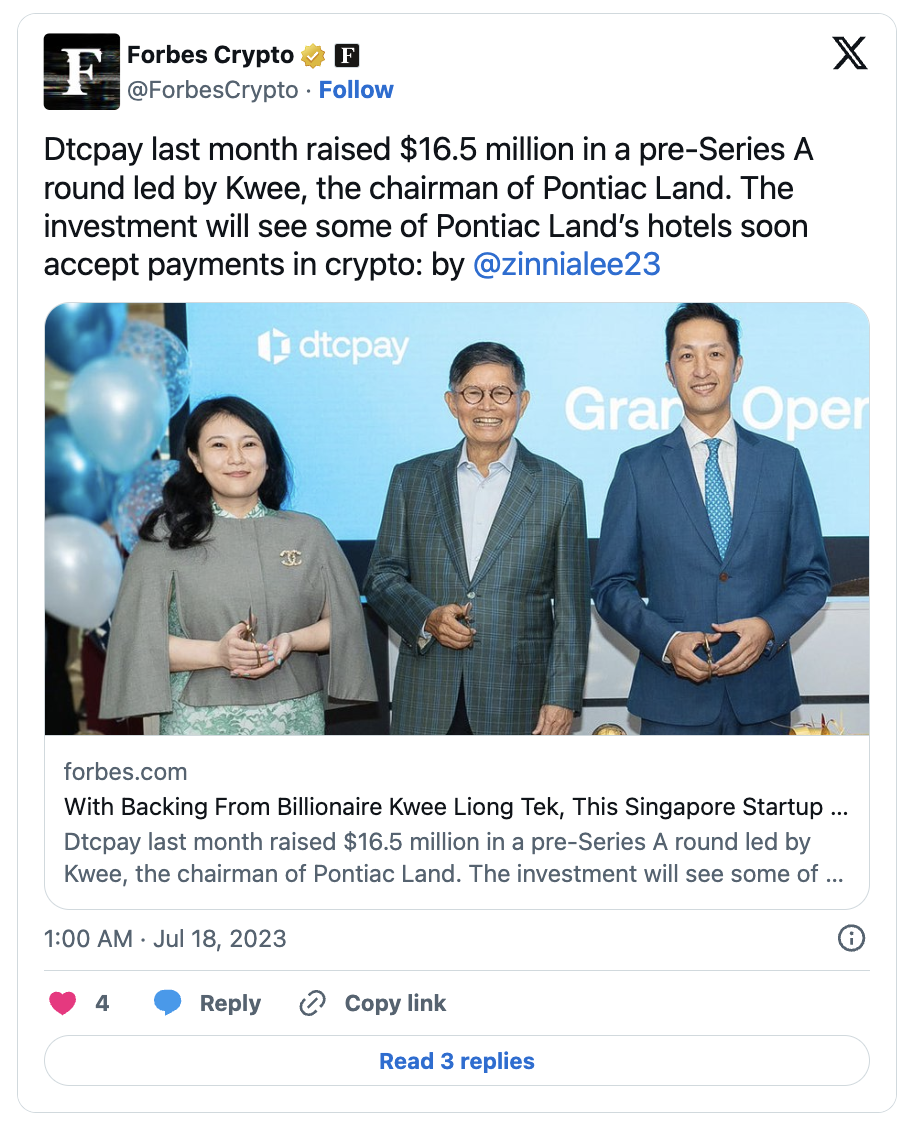

Established in 2019 and initially known as Digital Treasures Center, dtcpay was selected to participate in Mastercard’s Mastercard Start Path program for crypto and blockchain ventures in November 2022. It also drew attention by receiving support from Pontiac Land Group real estate holding in a pre-seed funding round in June.

The electronic payment system is widely used in Singapore, which is believed to have modern cryptocurrency regulations, including consumer protection. Coinbase and Ripple obtained a major payment institution license from MAS in October, marking a significant step in this regard.

The city-state, which has been making headlines recently, is also working on a central bank digital currency. However, MAS stated that it did not see an urgent use case for a CBDC project that individual users can use.

Continue Reading: https://en.coin-turk.com/singapore-based-dtcpay-to-launch-payment-system-with-fiat-and-crypto-assets/