Announcement

dtcpay Secures ISO/IEC 27001:2002 Certification

By securing this certification, dtcpay is reaffirming its commitment to maintaining and continuously improving the highest standards of security for its platform, protecting sensitive financial data from evolving threats.

6 Mar 2025 • 4 mins Read

As digital payment regulations and requirements evolve, our ISO/IEC 27001:2002 certification ensures we remain agile and prepared to meet new compliance challenges, creating an environment that fosters trust and encourages greater adoption of digital payment solutions.

dtcpay Secures ISO/IEC 27001:2002 Certification, Strengthening Information Security and Client Trust

dtcpay, a regulated Major Payment Institution (MPI) licensed by the Monetary Authority of Singapore (MAS), has officially secured the ISO/IEC 27001:2002 certification, a critical milestone in the company’s ongoing commitment to data security and compliance. This certification underscores our dedication to providing secure, reliable digital payment solutions in an increasingly complex and dynamic financial landscape.

ISO/IEC 27001:2002 is the globally recognized standard for information security management systems (ISMS). By securing this certification, dtcpay is reaffirming its commitment to maintaining and continuously improving the highest standards of security for its platform, protecting sensitive financial data from evolving threats. This achievement positions dtcpay as a leader in the space, building on our mission to ensure businesses and individuals can rely on a secure, compliant platform for all their digital payment needs.

dtcpay’s Security Strategy

At dtcpay, security isn’t just procedural – it’s at the heart of everything we do. The rigorous process we’ve undergone to earn this certification demonstrates the strong security protocols and systems we’ve implemented to ensure the integrity of our platform.

For our clients, this certification means a solidified commitment to safeguarding their financial data. With the increasing adoption of digital payment technologies, businesses need assurance that the platforms they rely on are not only efficient but also secure. ISO/IEC 27001:2002 certification offers a third-party guarantee that we are committed to ongoing risk assessment, continuous monitoring, and data protection across our entire platform. This is especially important for businesses operating in the rapidly evolving Web3 and digital payments landscape, where security breaches can have far-reaching consequences.

For individual users, the ISO/IEC 27001:2002 certification strengthens confidence that their personal data, financial transactions, and digital assets are handled securely. In a space where privacy and trust are paramount, this certification offers users peace of mind, knowing their interactions with dtcpay are protected by robust, globally recognized security measures.

The Web3 ecosystem, with its innovative approach to decentralized finance and digital assets, requires platforms like dtcpay to lead the way in security. By meeting the ISO/IEC 27001:2002 standard, we are helping create a safer, more reliable environment for the future of Web3 technologies, ensuring that businesses and users can confidently engage in the space without compromising on security or compliance.

Staying Ahead of Threats in the Digital Economy

While receiving the ISO/IEC 27001:2002 certification is an important milestone, it is just the beginning of our commitment to security. dtcpay regularly reviews and refines its security practices to ensure we remain ahead of potential threats. We will continue to engage with clients, regulators, and industry experts to ensure our platform adheres to the highest standards of security, compliance, and transparency.

As digital payment regulations and requirements evolve, our ISO/IEC 27001:2002 certification ensures we remain agile and prepared to meet new compliance challenges, creating an environment that fosters trust and encourages greater adoption of digital payment solutions.

Building a Reliable Digital Payment Ecosystem

Beyond building a payment platform, we pride ourselves on shaping the future of digital payments. This certification validates our ability to deliver reliable, secure, and compliant payment services, and reinforces our promise to continue innovating in a responsible way. As we expand our offerings, including our pioneering work in integrating stablecoins into traditional financial systems, we remain focused on delivering payment solutions that are as secure as they are innovative.

The integration of stablecoin payments into traditional financial systems is one of the most exciting areas of growth in the digital payments industry. With the ISO/IEC 27001:2002 certification behind us, businesses and individuals who use our platform can benefit from this innovation while knowing that their financial data and transactions are protected to the highest standards.

In addition to our focus on security, we are continuously exploring new ways to improve the user experience. From increasing transaction speeds to enhancing scalability, we are committed to ensuring that our solutions are not only secure but also efficient and future-proof. The ISO/IEC 27001:2002 certification is part of our ongoing commitment to ensuring that every aspect of our platform meets the highest standards of quality and security.

What’s Next

As we look to the future, dtcpay remains focused on expanding our platform’s capabilities and enhancing its security features to meet the growing needs of businesses and users worldwide. The ISO/IEC 27001:2002 certification is a key part of our strategy to build a more secure, compliant, and efficient digital payment ecosystem. With this certification in place, dtcpay is well-positioned to continue leading the way in providing cutting-edge payment solutions that are secure, scalable, and sustainable.

About dtcpay

dtcpay is a regulated Major Payment Institution (MPI) licensed by the Monetary Authority of Singapore (MAS) to conduct Digital Payment Token (DPT) services and other payment services under the Payment Services Act (PSA). As a leading provider of digital payment solutions, we pioneer the integration of stablecoin acceptance into traditional financial systems. With a vision to make global transactions seamless and sustainable, dtcpay empowers individuals and businesses to embrace the future of payments.

Learn more at dtcpay.com.

dtcpay powers stablecoin payments at one of Singapore’s most iconic departmental stores

dtcpay powers stablecoin payments at one of Singapore’s most iconic departmental stores

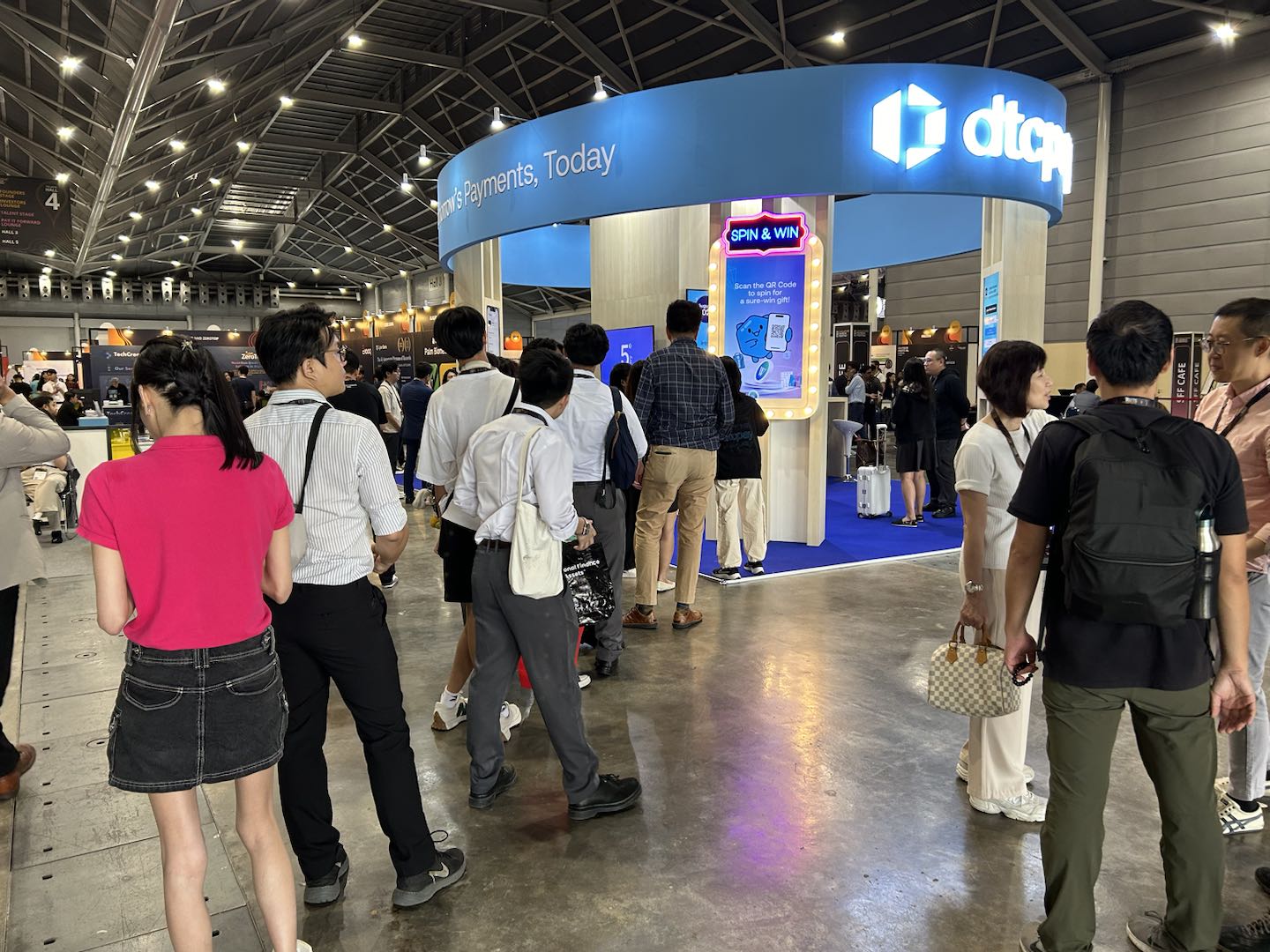

dtcpay PayByLink Lucky Draw station at the Singapore FinTech Festival 2024

dtcpay PayByLink Lucky Draw station at the Singapore FinTech Festival 2024

Hosting Luxembourg’s Minister of Finance, Gilles Roth, and his team at dtcpay’s Singapore headquarters

Hosting Luxembourg’s Minister of Finance, Gilles Roth, and his team at dtcpay’s Singapore headquarters

‘The Intersection of Web2 and Web3′ bar

‘The Intersection of Web2 and Web3′ bar

Specially concocted cocktails named after Visa and dtcpay’s innovative products

Specially concocted cocktails named after Visa and dtcpay’s innovative products

An interactive journey through time, as we step into a new era of payments

An interactive journey through time, as we step into a new era of payments

Angela Dong, Senior Manager of Development & Alumni from the Dean’s Office at NUS Business School, sharing how dtcpay is taking the lead in nurturing future leaders and how others can get involved

Angela Dong, Senior Manager of Development & Alumni from the Dean’s Office at NUS Business School, sharing how dtcpay is taking the lead in nurturing future leaders and how others can get involved

dtcpay Exchange where guests could redeem limited-edition event swag with Voyager Tokens

dtcpay Exchange where guests could redeem limited-edition event swag with Voyager Tokens

MBTI-based game for guests to discover their Blockchain Scent

MBTI-based game for guests to discover their Blockchain Scent

Alice Liu, dtcpay’s CEO & Co-Founder, with Adeline Kim, Visa’s Singapore Country Manager, unveiling the dtcpay Visa Infinite Card

Alice Liu, dtcpay’s CEO & Co-Founder, with Adeline Kim, Visa’s Singapore Country Manager, unveiling the dtcpay Visa Infinite Card

Adeline Kim, Visa’s Singapore Country Manager with Alice Liu, CEO & Co-Founder at dtcpay

Adeline Kim, Visa’s Singapore Country Manager with Alice Liu, CEO & Co-Founder at dtcpay