Announcement

Major Announcement: dtcpay Will Support Stablecoin & Fiat Payments Starting January 2025

As we wrap up 2024, dtcpay is excited to announce that, starting January 2025, we will transition to only support stablecoins for all our Digital Payment Token (DPT) payment services.

3 Dec 2024 • 4 mins Read

Table of Contents

- The Future of Payments is Stable: dtcpay is Now a Pure Stablecoins Digital Payment Token (DPT) Service Provider!

- Major Announcement: dtcpay Will Support Stablecoin & Fiat Payments Starting January 2025

- dtcpay’s Strategic Decision to Shift to Stablecoins: Why Now?

- Why Stablecoins?

- Leading the Way in Payment Innovation

- Looking Ahead: The Future of Payments is Stable

- Media Contacts

- About dtcpay

The Future of Payments is Stable: dtcpay is Now a Pure Stablecoins Digital Payment Token (DPT) Service Provider!

Major Announcement: dtcpay Will Support Stablecoin & Fiat Payments Starting January 2025

As we wrap up 2024, dtcpay is excited to announce that, starting January 2025, we will transition to only support stablecoins for all our Digital Payment Token (DPT) payment services. This means we will phase out support for Bitcoin (BTC) and Ethereum (ETH) by the end of this year, all other stablecoin & fiat currency services will continue to remain available.

dtcpay’s Strategic Decision to Shift to Stablecoins: Why Now?

This transition to a pure stablecoins model reflects our commitment to offering a secure, predictable, and regulatory-compliant payment solution. While cryptocurrencies like Bitcoin and Ethereum have played an important role in the digital finance ecosystem, their volatility creates challenges for businesses and consumers who need stability and reliability in their transactions.

By January 2025, in addition to USDT (Tether) and USDC (USD Coin) dtcpay plans to progressively support the following stablecoins, ensuring users can transact globally with a trusted and stable medium:

- FDUSD (First Digital USD)

- WUSD (Worldwide USD)

These stablecoins are pegged to fiat currencies like the U.S. dollar, offering the stability and security businesses and consumers demand.

Why Stablecoins?

- Stability: Unlike traditional cryptocurrencies, most stablecoins are less volatile and speculative in nature because they are commonly pegged to fiat currencies. This means businesses and consumers can transact with certainty and predictability, without worrying about drastic price fluctuations.

- Security and Compliance: Stablecoins offer a higher level of trust and security compared to other digital assets. They are typically backed by reserves, ensuring value retention and reducing the risks associated with more volatile assets.

- Scalability: By focusing on stablecoins, dtcpay can offer solutions that are globally scalable, ensuring seamless payments across borders without the high fees and delays often associated with traditional cross-border payments.

Leading the Way in Payment Innovation

This transition to a stablecoin model is a direct response to user demand, where a significant percentage of payments were made in stablecoins, as reflected in our recent one year’s transaction data. Payments in Singapore using stablecoins reached a record high of almost US$1 billion in the second quarter of 2024, led by transactions at merchant outlets, according to a report from Chainalysis (reported by Bloomberg). The surge in stablecoin adoption highlights the growing preference for stability and reliability in digital payments—factors that are driving dtcpay’s strategic decision to focus exclusively on stablecoins. By embracing this shift, we aim to meet the increasing demand for secure, predictable, and compliant payment solutions in an evolving digital finance ecosystem.

Some of our notable achievements include:

- The only Asia-based company selected for the Mastercard Start Path program.

- First regulated POS in Singapore to accept cryptocurrencies.

- 2022 SFF Global FinTech Award by Singapore FinTech Association (SFA).

- 2023 Best Cryptocurrency Payment Company by APAC Insider.

- 2023 Top Singaporean FinTech Seed Deal.

- Ranked 6th globally on Hoptrail’s Global Anti-Money Laundering (AML) Leaderboard and No.1 Virtual Asset Service Provider (VASP) in Singapore (Aug 2024).

- 2024 Best Multi-Currency Swap Platform by PAN Finance

- 2024 PayTech of the Year and Disruptor of the Year at the Asia FinTech Awards.

Additionally, we are thrilled to announce our collaboration with Singapore’s NETS SGQR+ initiative, enabling seamless stablecoin-to-fiat transactions through a unified QR code across the island. We’re also proud to be the first Major Payment Institution (MPI) in Singapore to join the Luxembourg House of Financial Technology (LHoFT), underscoring our global ambitions.

Looking Ahead: The Future of Payments is Stable

By transitioning to focus dtcpay’s Digital Payment Token (DPT) services purely on stablecoins, dtcpay is setting the stage for the future of global, digital payments. This move is designed to provide our customers with a more reliable, scalable, and secure payment experience—making digital finance predictable and stable.

As we enter 2025 with this clean slate, we remain committed to our mission of delivering Tomorrow’s Payments, Today. The future of payments is stable, and we’re proud to lead this evolution.

***

Media Contacts

Ashlee Zhang

Head of Marketing

dtcpay

ashlee.zhang@dtcpay.com

About dtcpay

dtcpay is a regulated Major Payment Institution (MPI) licensed by the Monetary Authority of Singapore (MAS) to conduct Digital Payment Token (DPT) services and other payment services under the Payment Services Act (PSA). As a leading provider of digital payment solutions, we pioneer the integration of stablecoin acceptance into traditional financial systems. With a vision to make global transactions seamless and sustainable, dtcpay empowers individuals and businesses to embrace the future of payments.

Learn more at dtcpay.com.

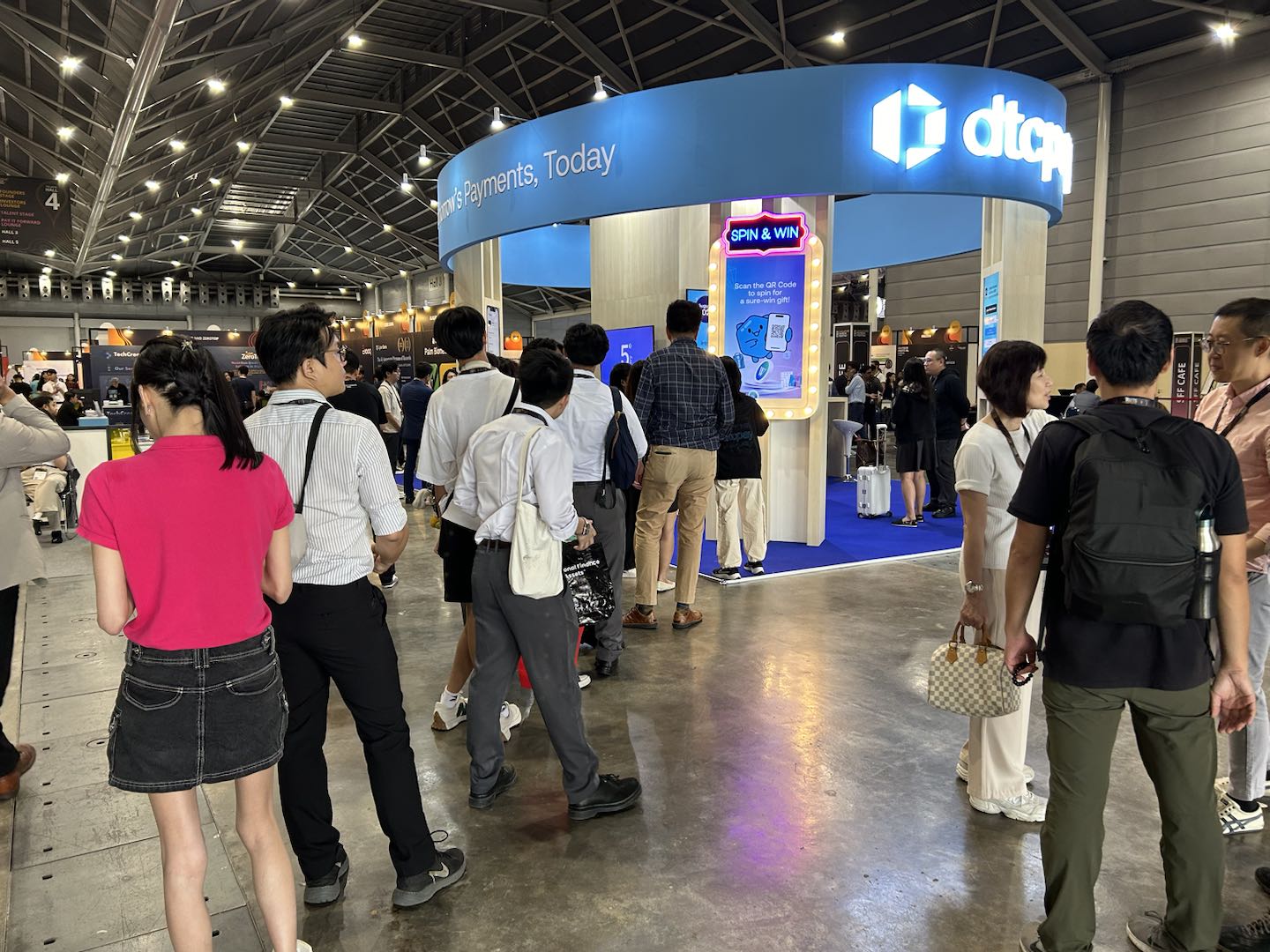

dtcpay PayByLink Lucky Draw station at the Singapore FinTech Festival 2024

dtcpay PayByLink Lucky Draw station at the Singapore FinTech Festival 2024

Hosting Luxembourg’s Minister of Finance, Gilles Roth, and his team at dtcpay’s Singapore headquarters

Hosting Luxembourg’s Minister of Finance, Gilles Roth, and his team at dtcpay’s Singapore headquarters

‘The Intersection of Web2 and Web3′ bar

‘The Intersection of Web2 and Web3′ bar

Specially concocted cocktails named after Visa and dtcpay’s innovative products

Specially concocted cocktails named after Visa and dtcpay’s innovative products

An interactive journey through time, as we step into a new era of payments

An interactive journey through time, as we step into a new era of payments

Angela Dong, Senior Manager of Development & Alumni from the Dean’s Office at NUS Business School, sharing how dtcpay is taking the lead in nurturing future leaders and how others can get involved

Angela Dong, Senior Manager of Development & Alumni from the Dean’s Office at NUS Business School, sharing how dtcpay is taking the lead in nurturing future leaders and how others can get involved

dtcpay Exchange where guests could redeem limited-edition event swag with Voyager Tokens

dtcpay Exchange where guests could redeem limited-edition event swag with Voyager Tokens

MBTI-based game for guests to discover their Blockchain Scent

MBTI-based game for guests to discover their Blockchain Scent

Alice Liu, dtcpay’s CEO & Co-Founder, with Adeline Kim, Visa’s Singapore Country Manager, unveiling the dtcpay Visa Infinite Card

Alice Liu, dtcpay’s CEO & Co-Founder, with Adeline Kim, Visa’s Singapore Country Manager, unveiling the dtcpay Visa Infinite Card

Adeline Kim, Visa’s Singapore Country Manager with Alice Liu, CEO & Co-Founder at dtcpay

Adeline Kim, Visa’s Singapore Country Manager with Alice Liu, CEO & Co-Founder at dtcpay

Sam Lin, dtcpay’s Chief Technology Officer, receiving the award.

Sam Lin, dtcpay’s Chief Technology Officer, receiving the award.