Industry Insights

dtcpay’s CSO, Anson Zeall Joins FATF Private Sector Consultative Forum 2024

Anson Zeall, dtcpay’s CSO & Head of Compliance, shares the key outcomes of FATF’s Private Sector Consultative Forum 2024 and what it means for VASPs moving forward.

9 Apr 2024 • 3 mins Read

Anson Zeall, dtcpay’s CSO & Head of Compliance, shares the key outcomes of FATF’s Private Sector Consultative Forum 2024 and what it means for VASPs moving forward.

Introduction

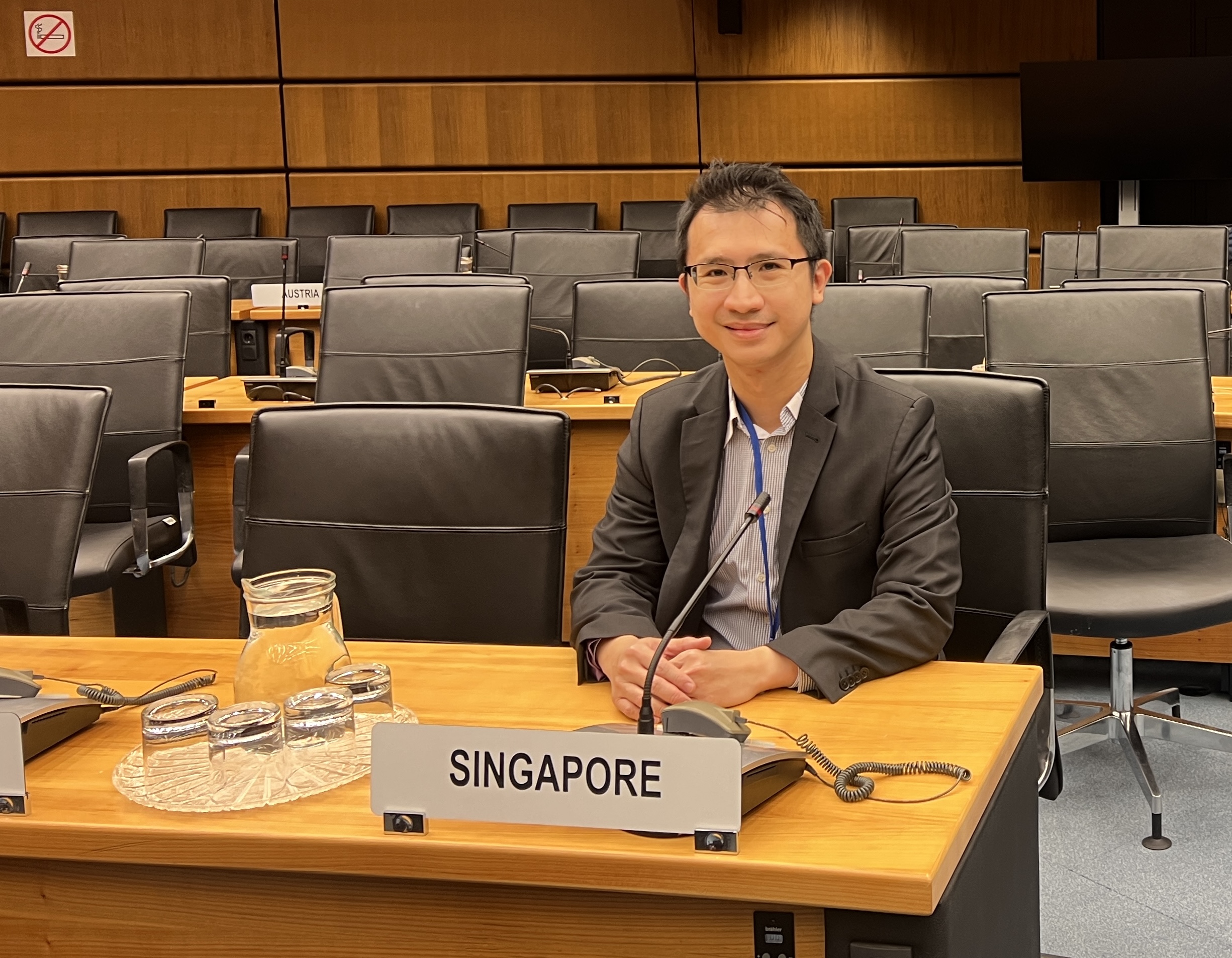

This April, Anson Zeall, our Chief Strategy Officer (CSO) & Head of Compliance, was invited to represent Singapore at the annual FATF Private Consultative Forum, alongside industry key players, DBS, Nium, and Crypto.com.

This year’s forum marks a significant turning point in the dialogue surrounding Recommendation 16 and Virtual Asset Service Provider (VASP) regulation. The forum also featured a panel on Central Bank Digital Currencies (CBDCs), marking the first time the private sector was invited to discuss associated risks.

In this blog, we explore the key outcomes and their impact on regulated payment providers like dtcpay.

Evolution of Recommendation 16

Since its introduction, Recommendation 16, also known as the “Travel Rule,” has posed significant challenges for VASPs. Mandating the exchange of customer information among VASPs, it has fundamentally altered the trustless nature of blockchain technology.

However, the 2024 forum reflected a notable evolution in the dialogue surrounding Recommendation 16. FATF’s receptiveness to reevaluate its impacts on VASPs and non-bank payment service providers signifies a progressive approach towards regulatory adaptation.

This acknowledgment underscores the importance of compliance without compromising financial inclusion, resonating across diverse regulatory landscapes.

Panel on Central Bank Digital Currencies (CBDCs)

Backing his assertions with data-driven insights, Zeall navigated through the burgeoning landscape of cryptocurrency payment apps. He highlighted the exponential growth trajectory, fueled by the widespread adoption of Bitcoin and its integration into commercial operations. Projections painted a vivid picture of a market poised for a remarkable compound annual growth rate (CAGR) of 17.23% by 2030. Notably, Zeall spotlighted the substantial progress, with 312 major brands already embracing crypto payments, signaling a palpable momentum towards mainstream acceptance.

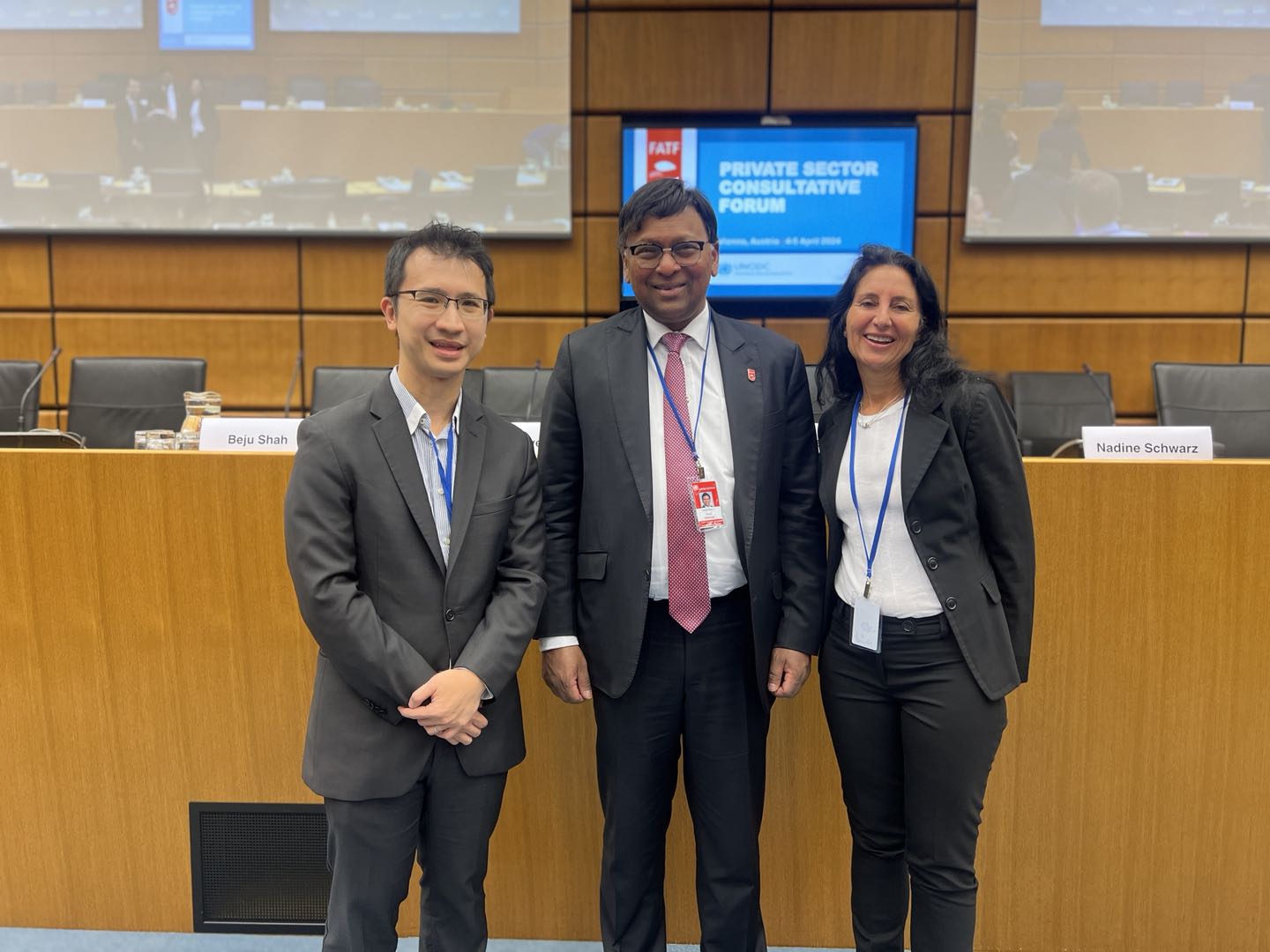

A highlight of the forum was the panel discussion on Central Bank Digital Currencies (CBDCs), where, for the first time, the private sector was invited to explore associated risks. This inclusion underscores FATF’s commitment to inclusive dialogue and proactive risk assessment.

President T Raja Kumar’s closing remarks, emphasizing collaborative adaptation and vigilance, served as a rallying call for industry-wide cooperation in combating financial crimes.

“law enforcement moves at the speed of law, criminals move at the speed of money,”

FATF President T Raja Kumar

Conclusion

Reflecting on the forum and recognizing the significance of feedback in shaping regulatory frameworks, International Digital Asset Exchange Association (IDAXA), led by Anson, announced plans to host a consultation session for VASPs and member associations.

This initiative aims to solicit valuable insights directly from stakeholders, contributing to a more effective, inclusive, and adaptive regulatory environment.

As a regulated payments provider, dtcpay is committed to actively participating in this crucial session, ensuring our perspectives are heard and considered in shaping the future of VASP regulation.

About dtcpay

dtcpay is a regulated payment service provider that offers reliable solutions for merchants to grow their revenues with higher acceptance rates for Fiat and cryptocurrency transactions. Our clients’ customers benefit from frictionless payment experiences whether they are using our award-winning POS+ terminal in-store or using our online checkout.